Prerequisites

To begin royalty processing, many things must already be in place in the system

- all works and products imported

- all contacts imported

- contributors to works assigned

- company statement months set in the Settings › Account › Company settings page

- client default currency determined, as all financials are handled in your default currency

Setting up royalties as a publisher with legacy data

Once the above prerequisites are in place then you will need to:

- configure sales channels

- get complete sales data in the system

- get complete contractual royalty data in the system

- payment history in the system

To get royalties working for the first time requires careful planning, because the system must account for past payments to ensure future accuracy, particularly with regard to advances and escalators.

Please read through the details below and consider the data you have accessible to determine your initial royalties strategy. Some paid for consultancy hours will be required to review the data, channel structure and strategy. Typically, this is around 10 hours, depending on your level of complexity.

Configure sales channels

A crucial process in setting up royalties in Consonance is determining your sales channel structure. The channel structure represents the financial reporting structure of your business. Because of its complexity, it has its own documentation that you should carefully review: sales masterchannels and channels

Get sales data into the system

- It is ideal if you have complete historical sales, per product. If you do, import historical sales using our import template working within your sales channel requirements. There could be some complexity here, particularly if you need to take unit escalators into account.

- If you don’t have detailed historical sales for products at the sales channel level, you will need to rely on the payee opening balance as desribed below, rather than importing any sales for periods prior to your first run in Consonance.

Get contract royalty data and payment history into the system

In order to get the royalty-specific data in, we provide a set of contract royalty spreadsheet templates to import your royalty contract data.

The first three sheets set the total payable royalty rates across all payees, at the appropriate level, including escalators. This is when your masterchannel and channel set up can come under pressure. Product level rates are the catch all default for the product. The masterchannel rate overrides any product default and any channel rate overrides both the masterchannel and the product default rate. You want to set the rate at the highest level possible, to avoid unnecessary duplication of effort and to catch all sales data for escalators, if necessary.

The fourth sheet is for payee splits, which should include your past payment data. Note that you may need to manually add non-contributor payees. Payees that are not designated as contributors on a work, such as agents, cannot be pre-filled into the template because the system doesn’t know they are associated with the work.

Your template will be pre-filled with your existing product and contributor information, but you can download an empty template to get a sense of the data required.

There are three ways to backfill your past payments history, with detailed explanations below:

- Detailing advances

- Adding up all past payments that are not advances

- Brought forward balance

Advances

Use these columns to specify agreed advances and due dates, where available. If they have been paid, you must include a paid date. You should not include paid advances in the “Past payment total amount”/“Last paid date” columns, and you should not include advances detailed here in the “Opening balance” column. The system will know what is paid and unpaid based on the dates being present or not.

Past payments

Use the “Past payment total/“Last paid date” columns to detail any non-advance payments as one lump sum, such as rights payments that impact advances earning out. You should not include advances that you added to the advances columns, in this column.

Brought forward balance

If advance information is not available per work, per payee, use brought forward balance as a single starting point. This opening balance will be used to calculate where the earn-out status of the contract is, at the point of your last royalty run. It should only include advances that are not detailed in the advances columns.

It is likely that advances and past payments columns would be used together, but it is unlikely that advances and past payment columns would be used together with opening balance.

Check your data automatically

- It can be hard to see why royalty calculations are not as expected. To help, we have implemented automated royalty checks, like the metadata checks, to point out common errors in royalty data. To ensure common errors are eliminated before running your royalties, read the royalty checks documentation and go to Insights › Royalty checks ⤴.

Test and run royalties:

- The most successful royalties migration projects include a preliminary royalty run and statement batch that replicate the most recent run you did before you adopt Consonance.

- This means you can compare the results of your old method and Consonance’s method, to ensure continuity for your payees and provide peace of mind that the royalty rates you’ve entered into the system match those you’ve used on previous runs.

- To perform this step, first import your royalty rates data.

- Next, import your sales up to and including your previous selling period – in other words, the same period that you have already run royalties up to, using your old method.

- Then calculate royalties in Consonance and generate statements for that period.

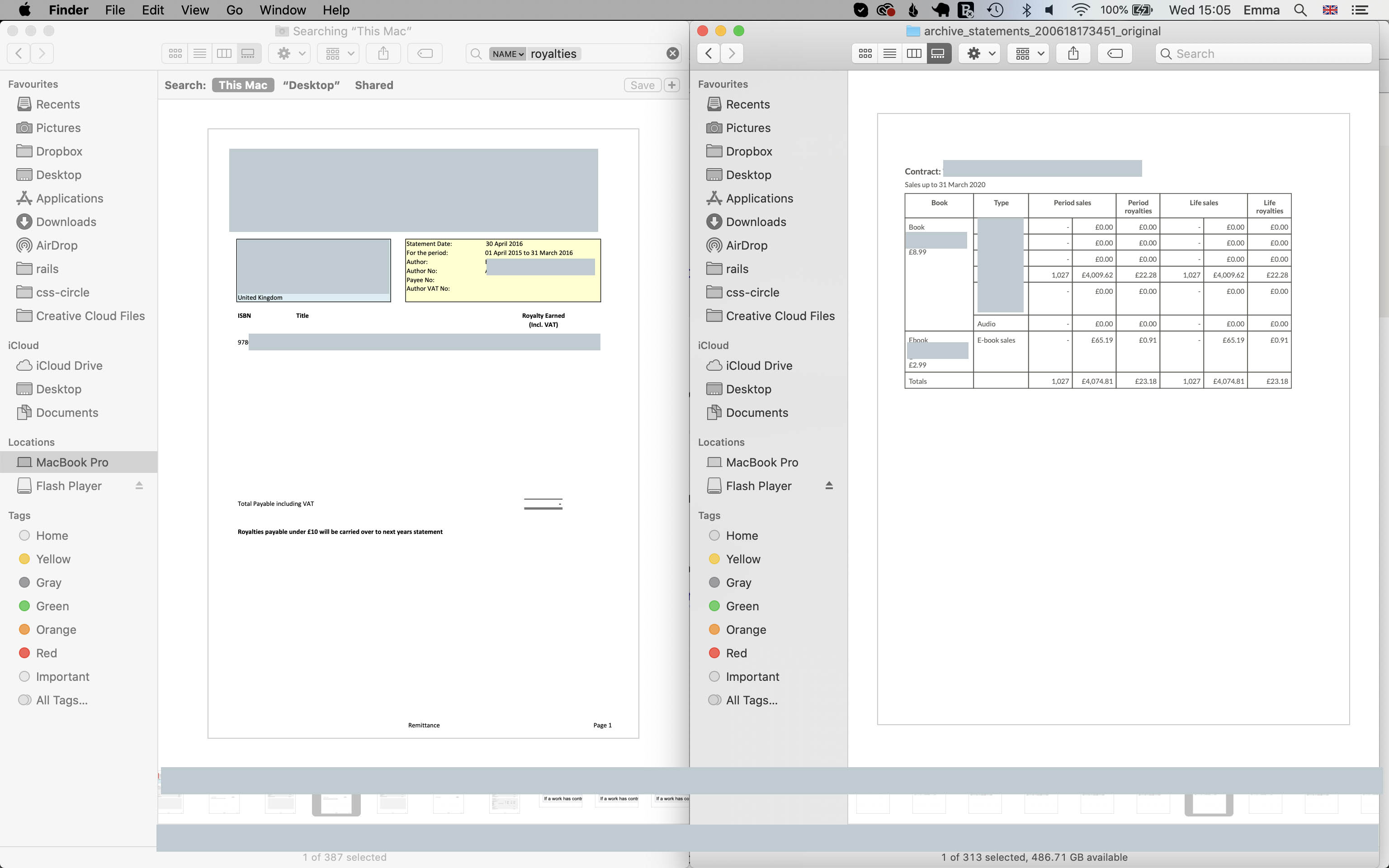

- Download the PDF statements, and compare and contrast them manually to your previous statements. One approach is to line them up in Finder or File Explorer windows on your computer, and step through them.

How royalties works

When you are doing your royalty run, Consonance breaks down royalty processing into two steps, calculating:

- Firstly, the total royalty due per product across all contributors within the royalty runs section. Data is gathered from the contract’s royalty specifiers and sales information.

- Then, the split between those contributors within the royalty statements section. Data is gathered from the royalty run and the contract’s payee split information.

Edge cases

Before you consider Consonance for your royalties needs, please consider the following edge cases not support by Consonance.

- While the system neatly handles payees with different rates for different products, Consonance does not process different escalators with payee splits. If one payee on a product gets an escalator, and another doesn’t, the royalty statement phase for that product will need to be completed outside of the system.

- Consonance supports contracts at a work level, not a series level.

- As a result, series editor royalties currently need to be a percentage of a work’s contract, rather than an additional percentage on top of the work’s royalty pot allocated to the contributors.

Get help

Raise a support ticket in the usual way to book a training session to get started with royalties. It’s necessary because your royalties set up is unique to you and the way you want to run your business.

The training consists of two stages: initial and top-up.

The initial training session is a walkthrough of the whole process – using one of your actual products, to make the training sticky

. This will provide you with the context you need to make the decisions about your royalties set-up in Consonance. The walkthrough includes:

- A ten minute overview of the whole process, then looping back to the start to cover each of the following points in more detail.

- How to choose channels

- How to input royalty rates

- How to import sales

- How to do a royalty run

- How to do a statement run

- How to record payments

Later, you’ll schedule a subsequent top-up call, when you have more data, either in a Q&A style or repeating the above.

Training costs £110 ex vat an hour and is delivered over video call, which is recorded, to which you can later refer. All training is also backed up with the written documentation you’re currently reading on this website.